The Costs of Gambling

[gs_8a]

Revenue Offsets

Because spending in a casino too often comes at the expense of spending that currently occurs in other parts of the economy, much of the tax revenue paid by casinos is offset by tax revenue losses from other sectors of the economy. Lottery proceeds, pari-mutuel (dog tracks, horse tracks and jai alai frontons) wagering taxes, any tax-parity arrangements with pari-mutuels and sales taxes collected by restaurants, hotels, movie theaters, amusement parks and retail establishments would all diminish if casinos open in Florida. These lost tax dollars must be subtracted from the amount of taxes paid by casinos.

[/gs_8a]

[gs_4z]

Regulatory Costs

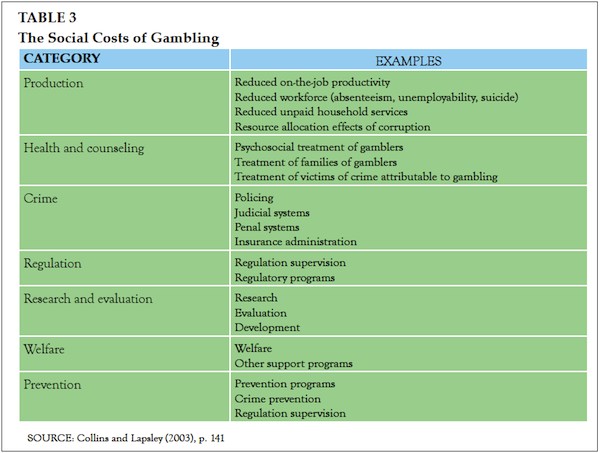

The bill to legalize destination casinos also creates a new regulatory bureaucracy to oversee the casinos. Done properly, gambling is expensive to regulate, and these costs also must be taken into account, further reducing the net tax benefits.

[gs_3a] [/gs_3a]

[/gs_3a]

[gs_9z]

Crime and Related Costs

Independent studies confirm that more gambling means more crime. In fact, Nevada spends more money per capita than any other state for law enforcement services. Right here in Florida, 35% of problem gamblers admit to committing crimes in order to support their addiction. The cost of additional law enforcement, losses to individuals and insurance companies, and services for victims means higher taxes for all of us.

[/gs_9z]

[gs_8a]

Another broken promise…

In the end, casino gambling it will be just like the state’s lottery & other gambling that failed in promises to fund & fix education & our state budget problems. In fact, when voters approved slot machines at pari-mutuel wagering facilities in Dade and Broward Counties, we were promised that they would generate $500 million per year for education. They generate a paltry 25% of this figure.

[/gs_8a]

[gs_4z]

The bottom line…

If huge new casinos are legalized, taxpayers will end up footing the bill for the crime, treatment for compulsive gamblers, & social costs of destitute gamblers that more gambling will cause – because taxes paid by casinos simply won’t cover all these costs